single life annuity with cash refund

How much disability income insurance do I need. Annuity plan can cover either single or joint life Flexible payout options to suit your need 2.

0-99 0-85 for life wcash refund annuity income payments.

. Single or Joint Life with installment refund. Annuities often come in 50 or 100. View annuity rates for single life annuities joint life annuities term certain annuities indexed annuities deferred annuities impaired annuities and previous annuity rates from 2021 to 2011.

Single Premium Immediate Joint Last Survivor Life Annuity Policy series. What are the chances of becoming disabled. Single life or joint life.

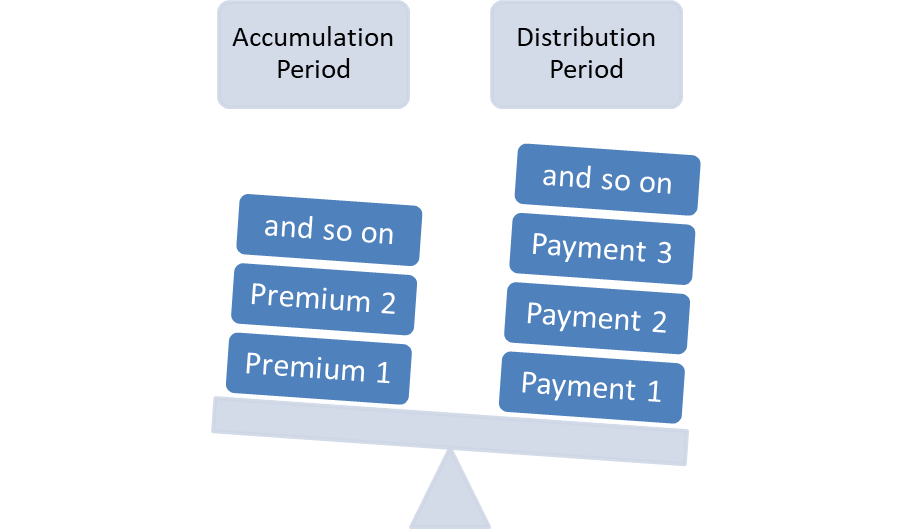

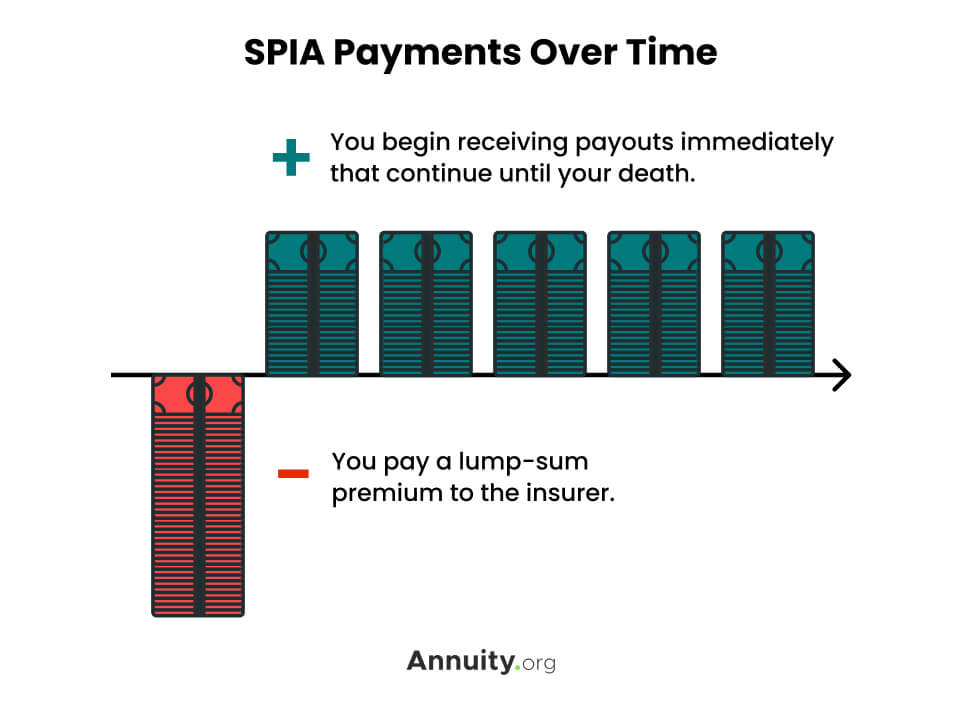

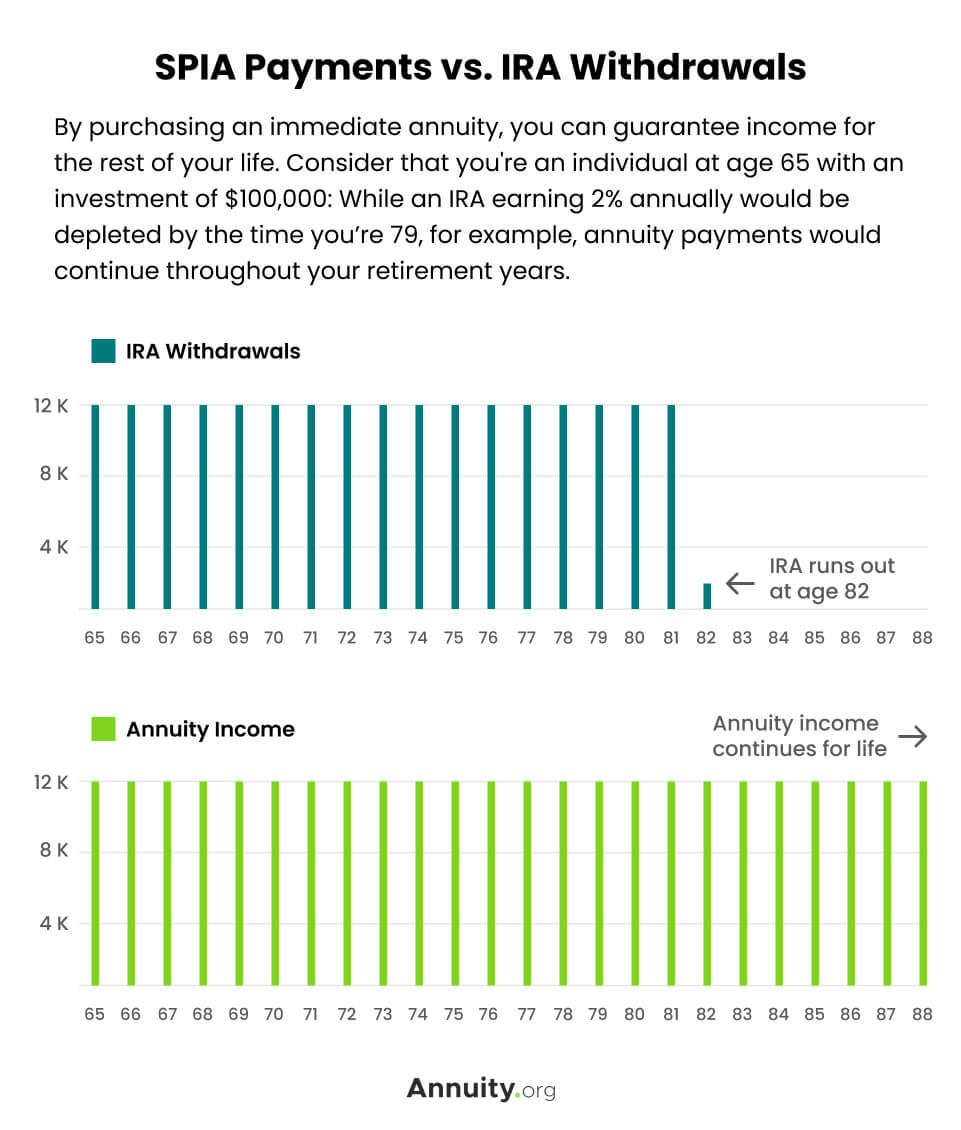

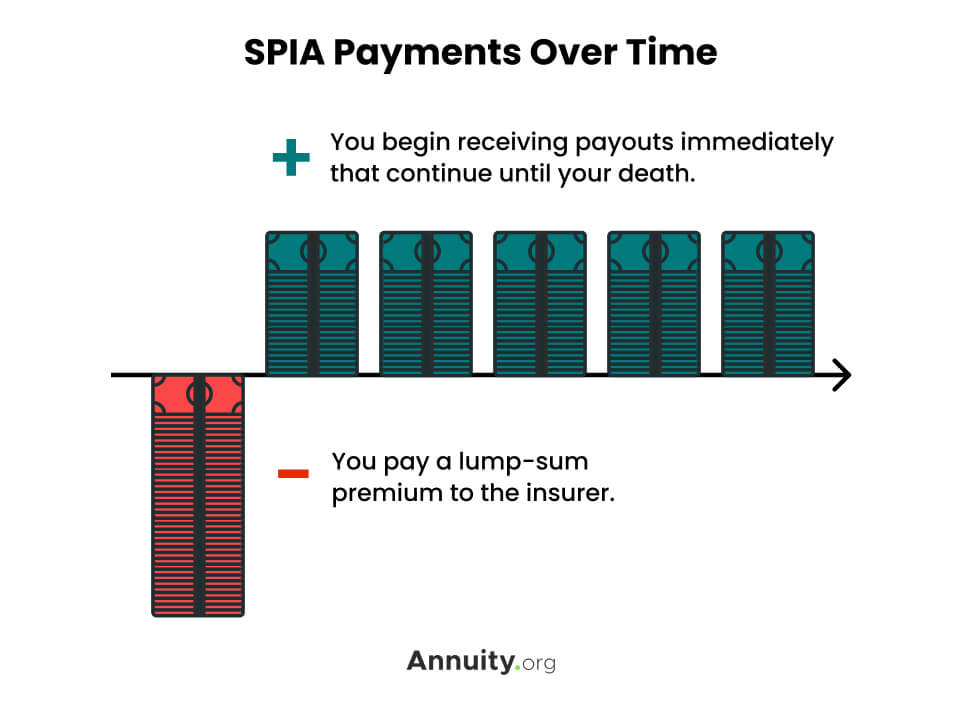

Single premium plan to get guaranteed income immediately for the rest of your life. Single Life or Joint Life Annuity with Refund. A single premium immediate annuity SPIA is purchased with a lump sum and starts paying out periodic income payments almost immediately or within the year.

Lock in the current interest rates for the annuity to be received later. Sometimes this type is referred to as a Certain and Continuous annuity. Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915 for that years.

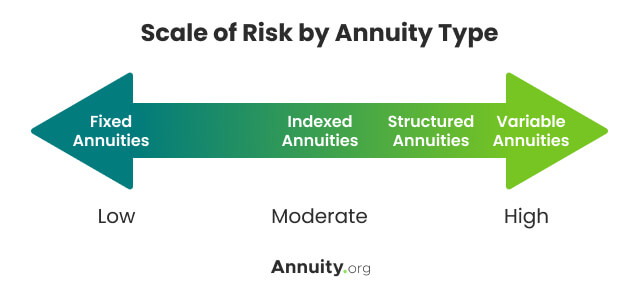

Annuity plan can cover either single or joint life Flexible payout options to suit your need 2. If you need the money this contract allows annuitants to. Most annuity types are designed for lifetime income but other types solve for principal protection CD returns and one type is even structured for market growth.

03044 A03044 and A11044. Form 8915-F replaces Form 8915-E. How long will my current life insurance proceeds last.

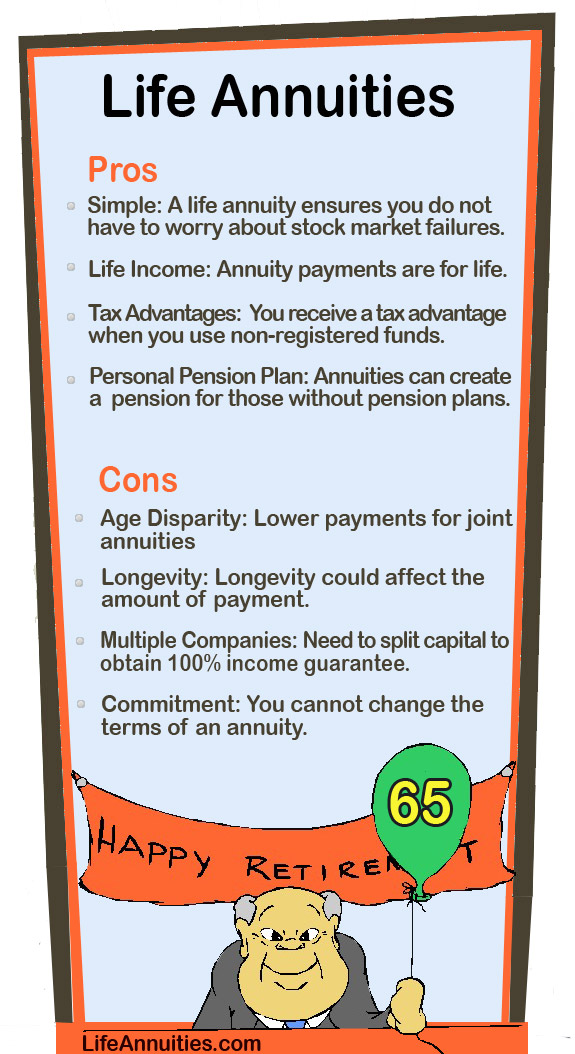

What are the tax advantages of an annuity. Payments will be made for as long as either annuitant lives. This option usually results in the highest monthly pension payout.

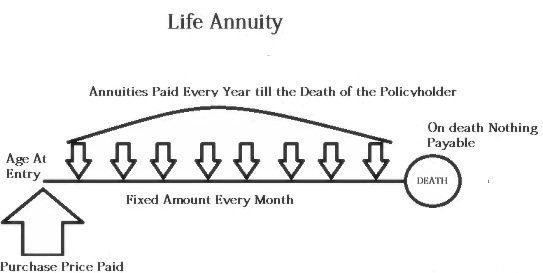

The advantage of the single life annuity is that for as long as youre living you will receive a higher monthly amount than you would have been paid from a joint annuity which covered your wife too. Single or Joint Life with cash refund. An annuity that provides monthly payments only to you as long as you live.

What are my needs for burial and final expenses. If the annuitants die before the total amount of income. Single lifetime Joint lifetime.

What are my long-term care insurance needs. Single Life and Joint Life Annuities Single life annuity. 85 years Single Pay Option B.

0-99 certain period life with certain period or life with installment refund annuity income payment options. 1977 Natl Integrity Take care. 03043 A03043 and A11043.

50 years Single Pay Option B. New York Life Guaranteed Lifetime Income Annuity IINew York Life Guaranteed Period Income Annuity II are issued by New York Life Insurance and Annuity Corporation a Delaware Corporation a wholly owned subsidiary of New. But the payments stop after your death leaving your spouse with no income.

If you need income to start as soon as possible consider transferring some or all of your 401k to a Single Premium Immediate Annuity SPIA. If you need income to start at a future date you. Single Premium Immediate Life Annuity with Cash Refund Policy series.

A single life or life only annuity provides payments for the life of the annuitant. For policies issued on minor life the date of commencement of risk shall be the date of commencement of the policy. Tax benefits on premium paid us 80CCC of Income Tax Act 1961.

One popular option to explore with a financial advisor is Life with Cash Refund where the insurance company pays the heirs any remainder of the initial deposit that was not paid to. An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization. The plan must use reasonable assumptions or factors but does not have to use 417e applicable interest and mortality rates to determine the present value of accrued benefits for any other distributions subject to IRC 417e that are calculated on a lump sum-based formula such as.

Seven or 10 years the annuity owner can cash out the annuity and take the funds. The top prize annuity is paid either weekly 7000 per week or annually 365000 How often are Lucky for Life drawings held. Life with Cash Refund.

Tax benefits on premium paid us 80CCC of Income Tax Act 1961. Second Prize Annuity Option 25000 a year for life. Certain single life optionscash refund and ten-year certainprovide for a beneficiary who may receive payments after your death.

Top Prize Cash Option 5750000 one-time payment. Like type 1 above payments would only end on the passing of the last annuitant after the certain period. Purchase annuities from your savings or accumulated NPS corpus.

Single or Joint Life with guaranteed payments for 5 to 30 years. 65 years Joint Life. Guarantee period years 5 to 30.

03045 A03045 and A11045. Buy Now or Buy Later. Single Premium Immediate Joint Last Survivor Life Annuity with Choice of Certain Period Policy series.

Single premium plan to get guaranteed income for life with the option to defer income by upto 10 years. Similar to type 3 payments are guaranteed for as long as one or both of the annuitants are living. How much will I earn in my lifetime.

This plan provides a lower monthly income for you in retirement but it provides income to your spouse once you die. 10-year periodic payments with no life annuity payments after. 2271 Guardian Life Joint life male female with cash refund.

The main alternative here is to sell future annuity payments to a third party at a discount. Single life male with cash refund. What is my life expectancy.

There is no way to access the underlying principal or get a refund. Second Prize Cash Option 390000 one-time payment. Maturity Age of the Life Insured Age as on last birthday Minimum.

Top Prize Annuity Option 1000 a day for life. One type of annuity per distribution request.

Annuity Contracts For Investment Or For Creating Income Stream

Types Of Annuities Understanding The Different Categories

The Cash Refund Annuity Pros And Cons 2022

Annuity Payout Options Immediate Vs Deferred Annuities

Warner Financial Group Financial Annuity Guaranteed Income

Annuity Beneficiaries Inherited Annuities Death

Period Certain Annuity What It Is Benefits And Drawbacks

Single Premium Immediate Annuity Spia Rates Pros Cons

Single Premium Immediate Annuity Spia Rates Pros Cons

New Pension Scheme Pensions Life Annuity Schemes

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Single Life Annuity What Is A Single Life Annuity Lifeannuities Com

Pros Cons Of Life Annuities With Infographic Lifeannuities Com

When Can You Cash Out An Annuity Getting Money From An Annuity